Every Paisa Counts

Urban Legend Dictates that High-Income Earners are Rich but We Believe Otherwise

Words: Alex K Babu Images: www.refinery29.uk

Money maketh the world go round. We live in a world where money may not be able to buy you love, but it could buy you a whole lot of other things, and we mean A LOT. You need money for everything and most of our lives seem to revolve around making money and spending it. Managing your finances isn’t rocket science and figuring out how to make and more importantly keep your money isn’t that hard either. Do believe us? Well, let the experts tell you themselves:

Myth: High-income earners are rich

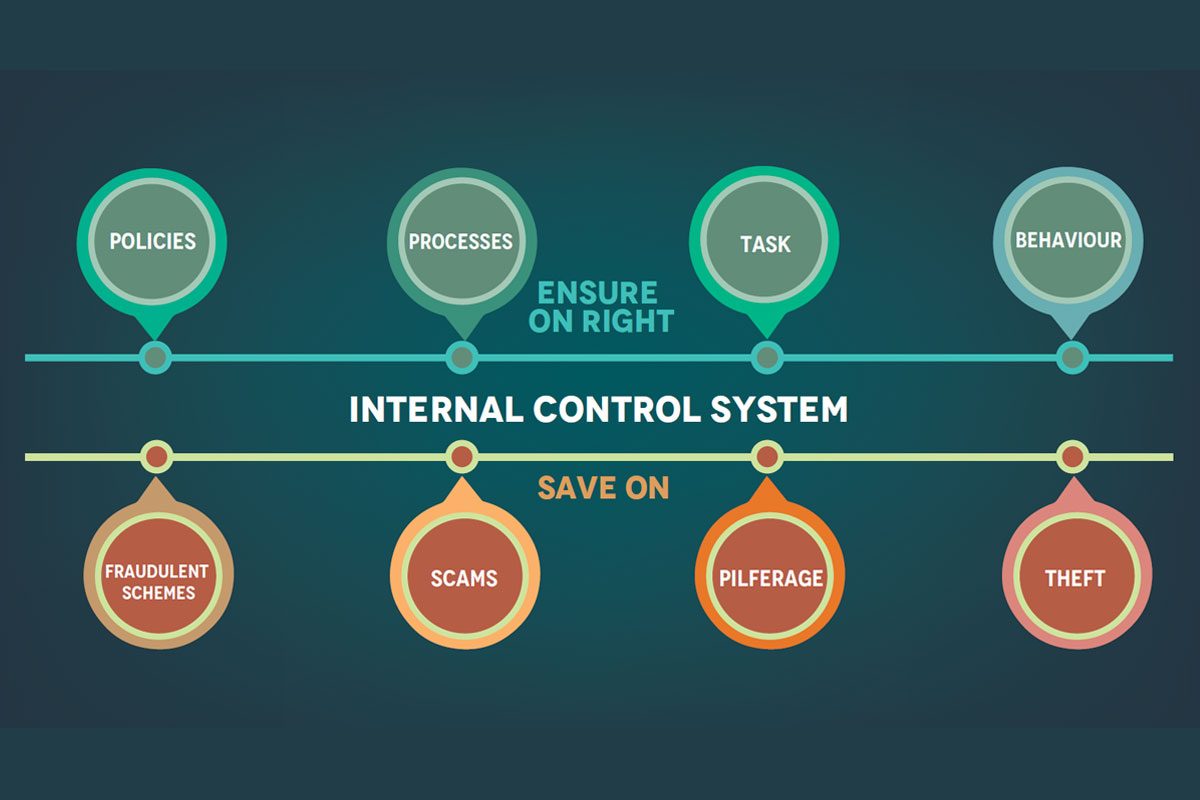

“Most people struggle financially because they do not know the difference between an asset and a liability” is one of the most quoted lines from my favourite author, Robert Kiyosaki. He goes on to interpret an `asset’ as a means that puts money in your pocket while a liability takes it away. High income is no guarantee for your wealth creation unless you display financial and emotional discipline to make the money work for you – especially when you can’t earn those multiple digits.

Are you a HENRY?

In early 2000, Fortune Magazine had coined the term “High Earners, Not Rich Yet’ as HENRY for those professionals who earned highly impressive incomes but showed very low net worth. Their hallmark was their poor investment or savings strategies.

If you are someone with a high salary (with an added income from your spouse) who cannot save much after paying for the mortgage, car loan, household expenses, schooling, taxes and so on – then you figure very much in the list. You bear the brunt of much of the existing and upcoming taxes (in India and pretty much everywhere else). Politicians consider you as easy targets for newer taxes and marketing experts vie for your attention but if you play along, then you would remain a Henry – and never truly rich.

This is the case with many high-earning professionals such lawyers, doctors, chartered accountants and business consultants. They spend most of their income to maintain a high lifestyle and some for the assets they consider are relevant and liquid.

In fact, we wrongly assume that our incomes will remain a six-figure number for years to come when in reality, it will not. You will peak your career before retirement and then stop working. There will be no more huge cash inflows. You will not be rich if you are not working but your lifestyle would have become addicted to the high income.

Emotional Discipline

You can observe drastic attitude towards life among such high-income earners; they spend much of their money and invest what is left while rich invest first, then spend what is left. They buy luxuries at the drop of a hat since they lack emotional discipline. Those who earn high need to understand few basic things; assets can be interpreted as those things that can be converted into money while debt is a way to spend your future income, in a structured manner.

Consider this: You want to buy a luxury car given your high income but what would be the true deliberations in your mind: How much would be the mileage or what would be service cost? No, you would be thinking about the EMI, down payment, cost of ownership in general etc. You would be deducting some of these from your monthly payments. If you are `truly rich’, then you would be calculating which of your investments would actually pay for this – month after month – without disturbing your ongoing cashflows.

Moreover, don’t go around considering yourself rich since your high income may be `high enough’ in certain cities where the income levels must be reasonable; in a big metro, you may be one among thousands with a similar income profile. Here, the real rich may not be working hard as they leave that job to their investments to take care of.

What are the True Assets?

I think it is all about your understanding of the basics and how you interpret them. Assets are things like stocks, bonds, and intellectual property and liabilities include mortgages, consumer loans, and credit cards. Kiyosaki thought rich acquired assets – clean and direct – whereas the middle-class or those, who earned a good income, amassed liabilities that they thought were assets.

High earners often believe that mortgage – wherein they shell out a substantial part of their income as EMIs – to be their biggest investment. Once the income stops, one will have either sell it or let it out to earn future income. At the end of the day, owning a home is expensive while they don’t always give you appreciation unless in a boom cycle. That’s why the truly rich think a home as a liability; if they want a bigger house, they would first create assets that would take care of the cash flows to pay for the house. “That’s why the rich get richer”” Kiyosaki explains.

We have seen enough such instances among us – Malayalees. Those who return with plenty of money from the Middle East or the US often end up in utter distress due to poor financial management and lack of awareness. This is the case with even those who earn sudden windfall like inheritance or real estate sale, etc. No matter how big the sum, money is no good unless you deploy it with financial intelligence.

We are all taught to how to get there, but never to manage it intelligently.

About the Author – Alex K Babu is the Founder, Chairman and Managing Director of Hedge Group of Companies. He holds responsibility for all-over strategy and oversight of the group’s strategic growth initiatives. Recognized for his youthful zeal, investment acumen and sound business intelligence, Alex believes that his role as a Business leader is to lead his organization and society through change. His keen business sense and a strong belief in India’s long-term growth prospects lead him to step up Hedge Equities in June 2008.